The Federal Housing Administration (FHA) recently approved 40-year mortgages in the United States, sparking interest among potential homebuyers seeking to reduce their monthly mortgage payments. While it may be tempting to consider a longer loan term to ease your monthly financial burden, it’s crucial to recognize the many pitfalls and long-term consequences associated with 40-year mortgages.

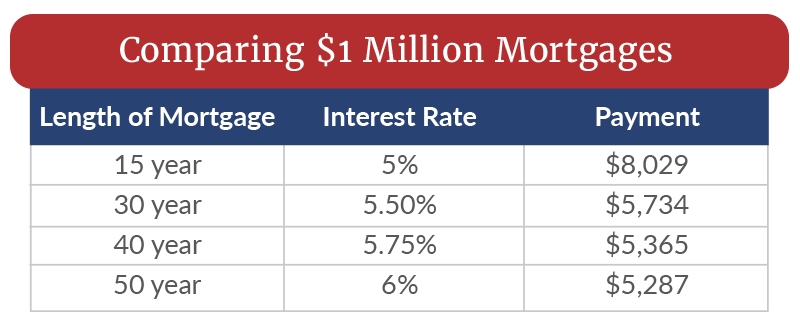

While it may look enticing based on the monthly payments broken down in the chart below, we’ll get into why it’s a very bad idea to embark on a 40 year mortgage journey.

- Exorbitant Interest Costs

The most glaring drawback of a 40-year mortgage is the substantially higher total interest costs. Extending your mortgage term by an additional ten years may indeed lower your monthly payments, but it also means that you’ll be paying interest for a more extended period. Over the life of the loan, this can result in an astronomical increase in interest payments compared to a 30-year mortgage. The additional interest paid could be better spent on investments, savings, or other financial goals that contribute to your overall financial well-being.

- Painfully Slow Equity Accumulation

A 40-year mortgage not only increases the interest you pay but also significantly slows down the rate at which you build equity in your home. With each monthly payment stretched over a longer period, a smaller portion goes towards the principal balance, delaying the rate of equity accumulation. This slower pace can impede your ability to achieve a debt-free lifestyle, a cornerstone of the No Debt Mindset. Furthermore, it can limit your options should you decide to sell your home in the future, as you’ll have less equity to put towards a new property.

Take a look at this Mortgage Amortization Calculator as well as Mortgage Term Comparison Chart to see what 30 vs. 40 year mortgages look like over their lifespan.

- Diminished Financial Flexibility

By opting for a 40-year mortgage, you’re committing to an additional decade of debt compared to a 30-year mortgage. This extended obligation can significantly hamper your financial flexibility and hinder your ability to pursue other important financial goals such as investing, saving for retirement, or funding your children’s education. Moreover, this long-term commitment can affect your ability to adapt to changing life circumstances, potentially leaving you in a precarious financial situation should you need to relocate, change careers, or address other unforeseen events.

- Restricted Appreciation Benefits

Real estate can be a viable long-term investment, but a 40-year mortgage alters the dynamics of your home’s potential appreciation. With the slower pace of principal reduction, any potential increase in your home’s value may be outweighed by the increased interest costs and diminished equity accumulation. Consequently, the overall return on your investment could be adversely affected, limiting your ability to leverage your home’s value to build wealth and secure a prosperous financial future.

- Heightened Risk of Negative Equity

In the event of a housing market downturn, homeowners with 40-year mortgages face a greater risk of finding themselves in a negative equity situation. This occurs when the outstanding balance on your mortgage exceeds the current value of your home. With slower equity accumulation, it becomes increasingly challenging to sell or refinance your property if you need to move or adjust your financial situation. This risk is further exacerbated by the fact that you would not want to consider cash-out refinancing or taking out a home equity line of credit (HELOC), which are options that some homeowners use to address negative equity.

- Limited Opportunities for Mortgage Acceleration

A shorter mortgage term provides ample opportunities to accelerate mortgage payments and reduce the loan’s overall lifespan. However, with a 40-year mortgage, the prospect of making extra payments may seem less appealing due to the already elongated term. As a result, homeowners may be less inclined to make extra payments or utilize strategies to pay off their mortgage early. This reluctance can ultimately prolong the debt burden and limit the financial benefits of owning a home.

- Psychological Impact of Long-term Debt

The psychological impact of carrying debt for an extended period should not be underestimated. The burden of a 40-year mortgage can cause considerable stress and negatively affect your overall quality of life. The pressure of long-term financial obligations may lead to feelings of being trapped, unable to make significant life changes or pursue new opportunities. By avoiding a 40-year mortgage and embracing the No Debt Mindset, you can work towards achieving financial freedom and peace of mind.

- Stricter Lending Requirements

Although 40-year mortgages may seem more accessible due to their lower monthly payments, lenders may impose stricter requirements for borrowers considering this option. These requirements may include higher credit scores, larger down payments, or more substantial cash reserves. As a result, some homebuyers may struggle to qualify for a 40-year mortgage despite the perceived affordability of the monthly payments.

- Opportunity Cost of Delayed Financial Goals

Opting for a 40-year mortgage can have a significant opportunity cost when it comes to achieving other financial goals. By committing to an extended loan term, you may delay your ability to invest in the stock market, contribute to retirement accounts, or save for your children’s education. Over the long run, these missed opportunities can have a profound impact on your overall financial health and the attainment of financial freedom.

- Reinforces a Debt-dependent Mindset

Finally, choosing a 40-year mortgage can inadvertently reinforce a debt-dependent mindset, which contradicts the principles of the No Debt Mindset. By normalizing long-term debt, it becomes more challenging to prioritize debt reduction and financial independence. Embracing a debt-free lifestyle is essential for creating a secure financial foundation and ultimately achieving financial freedom.

40-year mortgages may appear to offer short-term benefits in the form of reduced monthly payments, but the long-term consequences and hidden perils of this loan structure can severely impact your financial well-being. Instead of succumbing to the allure of an extended mortgage term, consider sticking with a traditional 30-year mortgage or exploring alternative strategies to achieve homeownership without compromising your financial future.

By adhering to the No Debt Mindset and prioritizing debt reduction, you can pave the way for a more secure and prosperous financial life. Remember, the key to financial freedom lies in making informed decisions that align with your long-term goals and values. Avoid the financial trap of 40-year mortgages and commit to a path that leads to true financial independence.

Leave a comment